Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Why Should I Invest In Nike? Well, let me tell you why this iconic brand is worth your consideration!

Nike isn’t just a company that makes sneakers; it’s a global powerhouse that has revolutionized the world of sports apparel. With its cutting-edge technology, trendy designs, and star-studded endorsements, Nike continues to dominate the market.

Investing in Nike means buying into a brand that is constantly innovating, expanding, and captivating consumers. So, if you’re looking to make a smart investment, Nike should definitely be on your radar!

What Makes Nike a Good Investment?

Nike remains as one of the most popular brands, as indicated by data from a teen survey. This enduring popularity bodes well for the company’s future success and highlights its ability to appeal to consumers across different demographics. With a strong brand presence, Nike has the potential to continue growing and capturing market share.

Furthermore, Nike has demonstrated responsible financial management strategies over the years. By increasing their dividend yield and repurchasing shares, the company has taken steps to enhance shareholder value. These actions not only provide investors with a steady stream of income but also indicate a commitment to return capital to shareholders and boost the stock’s value.

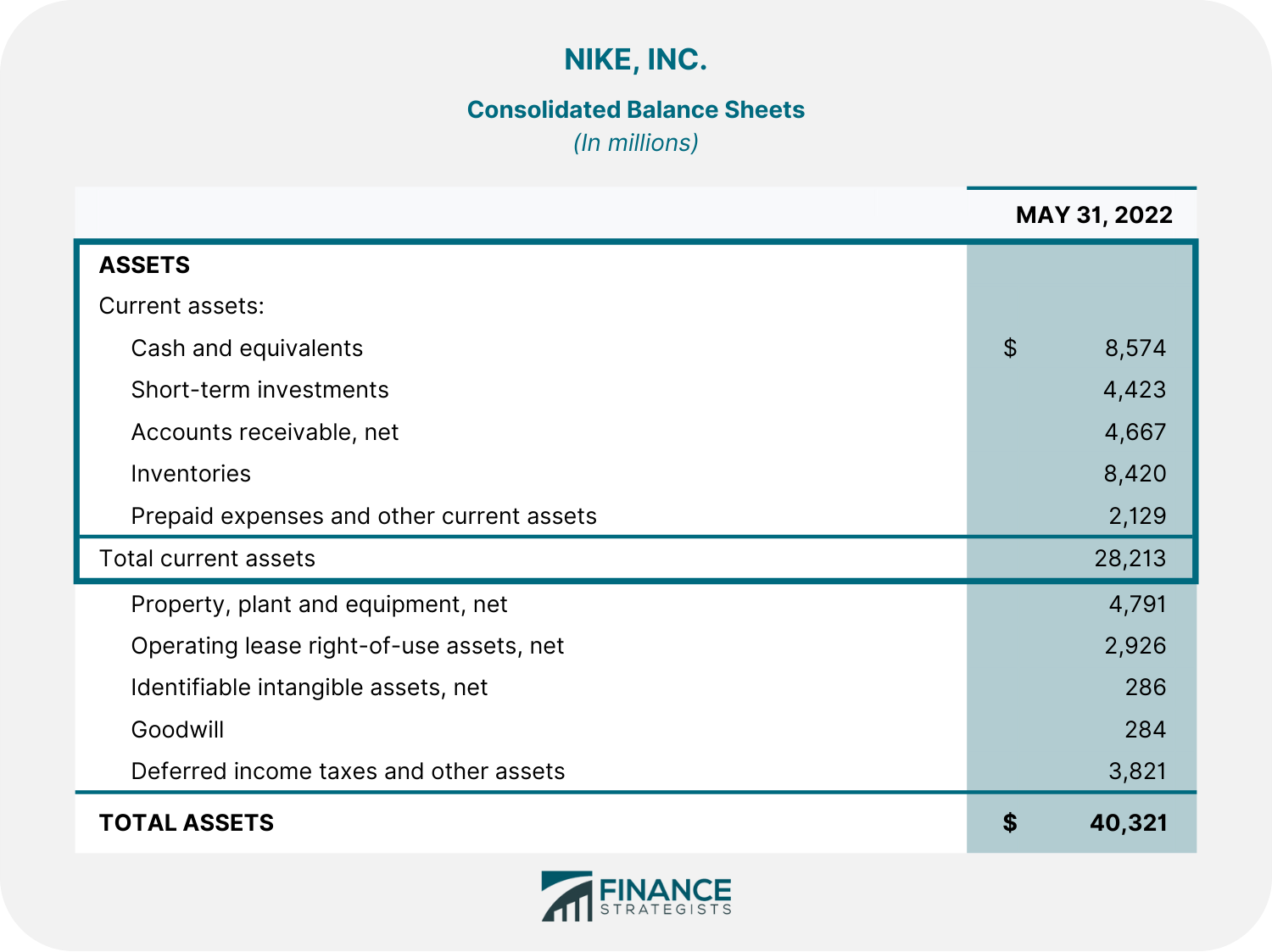

Another key factor that makes Nike a compelling investment is its robust financial position. The company boasts a healthy balance sheet, which is a testament to its strong financial management practices and ability to weather economic challenges. With a solid financial foundation, Nike is well-positioned to invest in innovation, marketing, and expansion, ensuring its continued growth and profitability.

Moreover, Nike’s effective management team and positive company culture further contribute to its attractiveness as an investment. The company is led by a team of experienced leaders who have a proven track record of driving success. Additionally, Nike has fostered a culture of innovation, diversity, and inclusivity, making it an attractive workplace for top talent. This strong leadership and positive company culture provide a solid foundation for future growth and value creation.

In summary, Nike’s enduring popularity, responsible financial management, strong balance sheet, effective leadership, and positive company culture make it a compelling investment choice. With these factors in mind, investors can have confidence in Nike’s ability to generate long-term value and deliver consistent returns.

Why Should I Invest in Nike?

Investing in a company like Nike can be a smart move for many reasons. As one of the world’s leading sportswear brands, Nike has built a strong reputation and a loyal customer base. In this article, we will explore the various reasons why investing in Nike can be a wise decision. From its strong financial performance to its innovation and market dominance, there are plenty of compelling reasons to consider adding Nike to your investment portfolio.

1) Strong Financial Performance

When considering an investment, it’s crucial to assess a company’s financial performance. Luckily, Nike boasts an impressive track record in this area. The company consistently delivers solid financial results, with strong revenue growth and healthy profit margins. Nike has a long history of generating positive earnings, making it an attractive option for investors seeking stability and consistent returns.

Moreover, Nike’s financial stability allows the company to invest in its growth and stay ahead of its competitors. By strategically allocating funds towards research and development, marketing, and expanding its global reach, Nike continues to innovate and drive sales growth year after year.

In addition to its strong financials, Nike also offers shareholders the potential for capital gains. Over the past several decades, Nike’s stock price has shown impressive growth, making it a rewarding investment for those looking to build long-term wealth.

Benefits:

– Strong revenue growth and healthy profit margins.

– Consistent positive earnings.

– Potential for capital gains.

Tips:

– Stay updated on Nike’s financial reports and news to make informed investment decisions.

– Consider a long-term investment approach for maximum returns.

2) Powerful Brand and Market Dominance

Nike’s iconic swoosh logo is recognized worldwide, making it one of the most powerful brands in the sportswear industry. The company has successfully built a strong brand image through its marketing efforts, sponsorships, and partnerships. This brand recognition translates into a significant advantage for Nike, as it enjoys a large customer base and a strong market presence.

Nike’s dominance extends beyond brand recognition — the company holds a substantial market share in the global sportswear industry. With a well-diversified product portfolio that includes footwear, apparel, and accessories, Nike caters to a wide range of athletic and lifestyle needs. Its ability to consistently deliver innovative, high-quality products gives Nike a competitive edge, solidifying its position as a market leader.

Investing in a company with such a strong brand and market dominance offers investors stability and the potential for long-term growth. Nike’s ability to adapt to changing consumer trends and its commitment to staying ahead of the competition make it an attractive option for those looking to invest in the ever-evolving sportswear industry.

Benefits:

– Powerful brand recognition worldwide.

– Large customer base and strong market presence.

– Well-diversified product portfolio.

– Commitment to innovation and staying ahead of the competition.

Tips:

– Keep an eye on Nike’s marketing campaigns and athlete endorsements to gauge consumer sentiment and market perception.

– Monitor the competitive landscape to understand any potential threats to Nike’s market dominance.

3) Continued Innovation and Sustainable Practices

One of Nike’s key strengths lies in its commitment to innovation. The company consistently invests in research and development to create cutting-edge products that meet the ever-changing demands of athletes and consumers. Nike leverages advanced technologies and partnerships to drive innovation across its product categories, ensuring it stays on the forefront of the industry.

In recent years, Nike has also prioritized sustainability, acknowledging the growing importance of environmental and social responsibility. The company has made significant strides in reducing its carbon footprint, implementing sustainable manufacturing practices, and promoting ethical labor standards throughout its supply chain.

Investing in a company that embraces innovation and sustainability is not only financially sound but also aligns with the values of many socially conscious investors. Nike’s commitment to driving positive change demonstrates its ability to adapt to evolving consumer preferences and positions itself as a leader in responsible business practices.

Benefits:

– Focus on innovation and cutting-edge product development.

– Commitment to sustainability and ethical practices.

Tips:

– Stay informed about Nike’s latest product launches, collaborations, and technological advancements.

– Follow Nike’s initiatives and progress in sustainability to assess the company’s long-term viability and responsible practices.

Is Investing in Nike Right for You?

Investing in Nike can offer a range of benefits, from its strong financial performance to its global brand recognition, market dominance, and commitment to innovation and sustainability. However, before making any investment decisions, it’s crucial to consider your individual financial goals, risk tolerance, and investment strategy. Conduct thorough research, consult with financial professionals, and evaluate how Nike aligns with your portfolio objectives.

Remember, investing always carries a certain level of risk, and past performance is not indicative of future results. Assess your own financial situation, diversify your portfolio, and make informed decisions based on your own analysis and goals. With careful consideration, investing in Nike could be a wise move for those seeking steady growth and a stake in a company that continues to shape the sportswear industry.

Key Factors to Consider When Investing in Nike

Growth Potential

Anyone considering investing in a company needs to evaluate its growth potential. For Nike, the sportswear market shows no signs of slowing down. The global sportswear industry is projected to continue its upward trajectory, driven by increased focus on health and fitness, athleisure trends, and growing consumer demand for high-quality products.

Nike’s ability to capture market share and stay at the forefront of innovation positions the company for continued growth. With its strong brand recognition, diverse product offerings, and expansion into emerging markets, Nike has the potential to tap into new customer segments and drive revenue growth in the years to come.

Financial Performance and Stability

Before investing in any company, it’s essential to assess its financial performance and stability. Nike has a long-established track record of delivering strong financial results, including consistent revenue growth, healthy profit margins, and positive earnings.

Investors should monitor Nike’s financial reports, paying attention to key metrics such as revenue growth, gross margins, and operating expenses. Additionally, analyzing the company’s debt levels, cash flow, and return on investment can provide insights into its financial health and ability to weather market uncertainties.

Market Position and Competition

Nike’s dominant market position is a significant factor to consider when investing in the company. As a global leader in the sportswear industry, Nike enjoys a substantial market share and benefits from strong brand recognition.

However, it’s important to keep an eye on the competitive landscape. Nike faces competition from both traditional sportswear brands and emerging players. Monitoring shifts in the market, consumer preferences, and the strategies of competitors can help investors assess Nike’s ability to stay ahead of the game and sustain its market dominance.

Brand Reputation and Customer Loyalty

Nike’s strong brand reputation and customer loyalty contribute to its long-term success as a company. The company’s ability to connect with consumers through marketing campaigns, athlete partnerships, and engaging brand experiences has built a loyal customer base.

Consider the strength of Nike’s brand reputation and whether it resonates with your own investment goals. An established and respected brand can help a company navigate challenges and maintain customer loyalty, offering a level of stability and long-term growth potential.

Understanding the Risks

Investing in any company carries inherent risks, and Nike is no exception. Risks to consider when investing in Nike include:

Market Volatility

The stock market is subject to fluctuations, and Nike’s stock price can be affected by broader market conditions. Economic downturns, geopolitical events, and industry-specific factors can all influence the value of your investment in Nike.

Competition

While Nike enjoys a dominant market position, competition in the sportswear industry is fierce. The emergence of new players or the disruptive strategies of existing competitors could impact Nike’s market share and financial performance.

Consumer Preferences and Trends

Consumer tastes and preferences are constantly evolving. Changes in fashion trends, shifts in consumer behavior, or the emergence of new technologies can all impact Nike’s sales and brand perception.

Investors should closely monitor industry trends, consumer sentiment, and competitor strategies to assess any potential risks to Nike’s business.

Final Thoughts

Investing in Nike can be a smart move with the potential for long-term growth and steady returns. The company’s strong financial performance, market dominance, and commitment to innovation and sustainability make it an attractive option for investors.

However, it’s crucial to conduct thorough research, analyze your own financial goals and risk tolerance, and stay informed about market conditions and industry trends. Consulting with financial professionals can also provide valuable insights and guidance for making informed investment decisions.

Remember, investing always carries risks, so diversify your portfolio and ensure your investments align with your long-term objectives. By considering the key factors discussed in this article and staying vigilant, you can make sound investment decisions and potentially reap the rewards of investing in a company like Nike.

Frequently Asked Questions

Welcome to our frequently asked questions section. Here, we provide answers to common queries about Nike as an investment opportunity.

What factors make Nike a good investment?

When considering Nike as an investment, several factors contribute to its appeal. Firstly, Nike remains an extremely popular brand, as evidenced by data from various surveys. This indicates a strong consumer demand and potential for future growth. Additionally, Nike has consistently increased its dividend yield over the years, demonstrating financial stability and a commitment to rewarding shareholders. The company also actively buys back shares, which can enhance shareholder value. Furthermore, Nike boasts a healthy balance sheet, supported by an effective management team that has a track record of delivering strong financial performance. Lastly, Nike has a great company culture that fosters innovation, diversity, and inclusivity, making it an attractive long-term investment option.

Why should people buy Nike?

People should consider buying Nike products for several reasons. First and foremost, Nike is renowned for manufacturing shoes of exceptional quality and stylish designs. Whether it is for athletic performance or fashionable wear, Nike consistently delivers products that meet both aesthetic and functional needs. Additionally, Nike has established itself as a prominent player in the apparel industry, offering a wide range of clothing options suitable for professional and casual settings. Moreover, Nike’s extensive sponsorship of various sports teams displays their commitment to athletic excellence and further contributes to brand recognition. However, what truly sets Nike apart is their unparalleled expertise in branding. The company’s marketing strategies are unmatched, making Nike a household name and cementing its status as a leader in the industry.

Why not to invest in Nike?

Investing in Nike may not be a wise decision at the moment due to various factors. Firstly, the stock has experienced a decline of 8.2% in 2023, placing it among the worst-performing stocks in the S&P 500 index. This decline suggests potential risks and challenges ahead. Additionally, Nike is facing challenges such as excessive inventory and insufficient demand, which can negatively impact its financial performance. Moreover, the sluggish economy in China, which is Nike’s second-largest market, poses a significant hurdle for the company. Lastly, Nike is also facing competition from emerging brands like On and Hoka, further adding to its woes. Considering all these factors, potential investors should carefully evaluate the current situation before making any investment decisions regarding Nike.

How much do I need to invest in Nike?

In order to invest in Nike, new investors are required to make a minimum initial investment of $500 or commit to recurring investment deposits of at least $50. These requirements ensure that individuals who wish to invest in Nike have a solid financial commitment to the company. By setting these thresholds, Nike aims to attract serious investors who are willing to make a substantial investment in the company and its future growth. Investing in Nike allows individuals to potentially benefit from the success and market performance of one of the largest and most renowned sportswear brands in the world.

Summary

Nike is a great company to invest in because it is a leader in the sports industry. They have a strong brand, high-quality products, and a global presence. Investing in Nike can offer long-term growth and potential financial rewards as the company continues to innovate and expand its market share. It’s important to do your own research and consult with a financial advisor before making any investment decisions, but considering Nike as part of your investment portfolio could be a smart choice.

In conclusion, investing in Nike can be a wise decision due to its position as a market leader, trusted brand, and global reach. By investing in Nike, you have the opportunity to benefit from the company’s continued success and potential financial growth. Just remember to do your homework and seek professional advice to make the best choices for your financial goals.

Recent Posts

Puma sneakers have different sizing depending on the specific style and model. It's recommended to check the product description or reviews for each sneaker to determine if they run small or large....

How To Lace Puma Shoes? If you're a fan of Puma shoes and want to learn how to lace them, you've come to the right place! Lacing your Puma shoes properly not only adds a stylish touch but also...