Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Nike, a global leader in athletic footwear and apparel, is a company worth considering for investment. With a strong brand presence, innovative products, and a solid financial performance, Nike has proven to be a good investment choice. The company’s consistent growth, focus on sustainability, and ability to adapt to changing consumer trends make it an attractive option for investors looking for long-term value. Additionally, Nike’s commitment to social responsibility and diverse partnerships further strengthen its investment potential.

Is Nike A Good Company To Invest In? If you’re thinking about investing your hard-earned money, Nike might be a company worth considering. With its iconic swoosh logo and reputation for innovation, Nike has become a global leader in the sportswear industry.

But what makes Nike stand out in the world of investment options? Well, for starters, Nike has a strong brand presence and loyal customer base, which translates into consistent sales and revenue growth.

Moreover, Nike’s commitment to sustainable practices and innovation in product development sets it apart from its competitors, ensuring its long-term success and potential for investment returns.

Is Nike a Good Company to Invest in?

When it comes to investment opportunities, it’s crucial to carefully consider the company you’re investing in. One company that often garners attention in the investment world is Nike. With its global brand recognition and dominance in the athletic apparel and footwear industry, many investors wonder if Nike is a good company to invest in. In this article, we will explore the factors that make Nike an attractive investment option, as well as potential risks and considerations.

The Growth Potential of Nike

One compelling reason to consider investing in Nike is the company’s impressive growth potential. With a strong market presence in the United States and globally, Nike has consistently shown its ability to adapt and stay ahead of trends. The company’s focus on innovation, high-quality products, and strategic marketing campaigns has allowed it to maintain a significant market share and expand into new markets.

Nike’s expansion into emerging markets, such as China and India, presents promising opportunities for growth. As these economies continue to develop, the demand for athletic apparel and footwear is expected to increase. Nike has already established a strong presence in these markets and is well-positioned to capitalize on this growing demand.

Additionally, Nike’s direct-to-consumer (DTC) business model has been a key driver of growth. By selling products through its website and company-owned stores, Nike can capture a higher portion of sales revenue and collect valuable consumer data. This allows the company to personalize the customer experience and increase customer loyalty.

The Competitive Landscape

Although Nike has a strong market position, it is essential to analyze the competitive landscape before making an investment decision. Nike faces fierce competition from other well-established athletic apparel and footwear brands, such as Adidas and Under Armour. These companies have their loyal customer base and are constantly innovating to stay relevant in the industry.

Furthermore, the rise of e-commerce has transformed the retail industry, and Nike must adapt to this changing landscape to remain competitive. Online retailers like Amazon have disrupted traditional retail channels, and Nike needs to continue investing in its e-commerce capabilities to reach consumers directly and navigate this digital shift.

Investors should also consider potential risks, such as changing consumer preferences, economic downturns, and supply chain disruptions. A thorough analysis of these factors is crucial in evaluating Nike’s long-term growth potential and assessing the risks associated with investing in the company.

Financial Performance and Stock Analysis

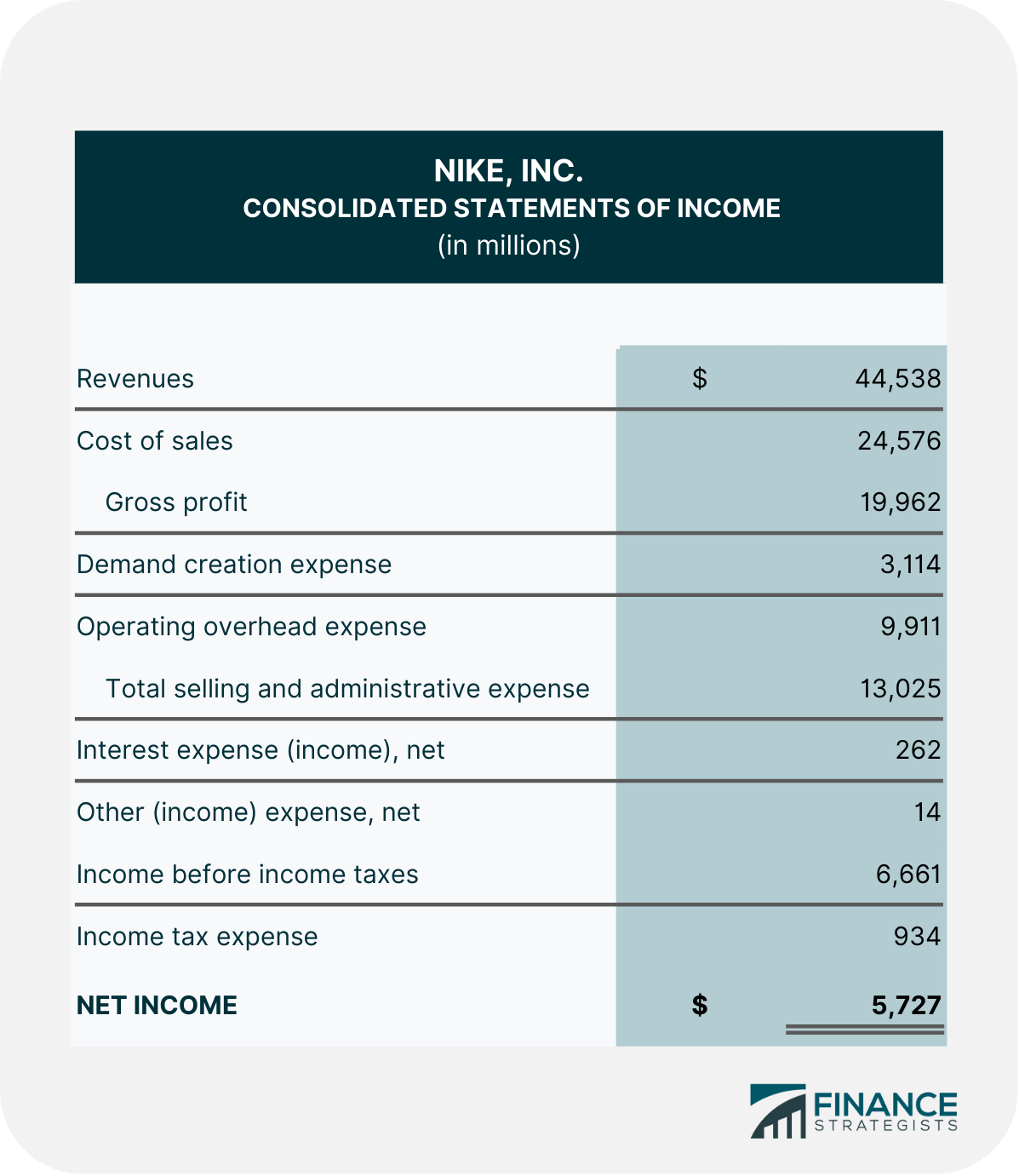

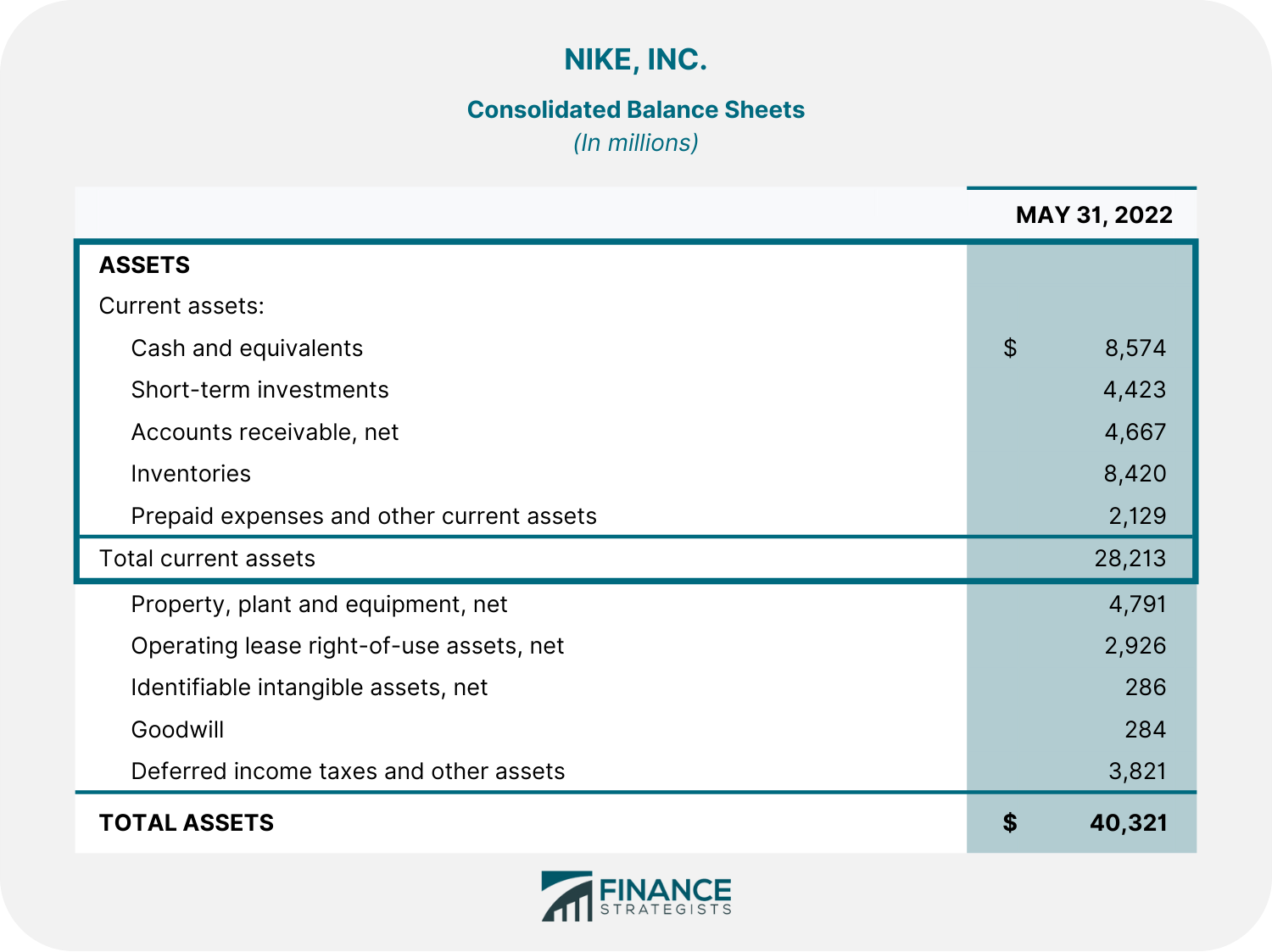

A vital aspect of assessing a company’s investment potential is analyzing its financial performance. Nike has a solid track record in terms of revenue and earnings growth. The company consistently generates strong cash flows, which allows it to reinvest in its business, pay dividends to shareholders, and repurchase its own stock.

Furthermore, Nike’s stock has shown significant long-term appreciation. Over the years, the company has consistently outperformed the broader market and delivered attractive returns to its shareholders.

However, it’s important to note that no investment is without risk, and past performance is not a guarantee of future results. Investors should carefully analyze Nike’s financial statements, assess key financial ratios, and consider the company’s valuation when making investment decisions.

The ESG Factors to Consider

In recent years, Environmental, Social, and Governance (ESG) factors have gained prominence in the investment landscape. Investors are increasingly considering a company’s commitment to sustainability, ethical practices, and societal impact when making investment decisions.

Nike has made significant strides in addressing ESG concerns. The company has set ambitious sustainability goals, such as reducing carbon emissions, increasing the use of sustainable materials, and improving working conditions in its supply chain. Nike’s commitment to ESG factors can help position it favorably in the eyes of socially conscious investors.

However, investors should conduct their own research and determine how these factors align with their personal values and investment goals.

Evaluating Nike as an Investment

After considering the growth potential, competitive landscape, financial performance, and ESG factors, it is clear that Nike has many positive attributes that make it an appealing investment option. The company’s global brand recognition, focus on innovation, and ability to adapt to changing consumer preferences provide a strong foundation for future growth.

However, it’s essential to remember that investing in individual stocks carries inherent risks. It’s crucial for investors to conduct thorough research, diversify their portfolios, and consult with a financial advisor before making any investment decisions.

If you believe in Nike’s long-term growth potential and are comfortable with the inherent risks, investing in the company may be a sound decision. As with any investment, staying informed and regularly reassessing your investment thesis is key to making sound investment decisions.

#Additional H2 Headings:

Factors to Consider When Investing in Nike

Before making an investment decision, it’s important to consider several factors that may influence Nike’s performance. Here are three key areas to focus on:

Diversification and Portfolio Allocation

Investing in individual stocks, like Nike, carries risk. It’s crucial to diversify your investment portfolio to mitigate this risk. Here’s why:

Professional Opinions and Analyst Recommendations

When considering an investment in Nike, it can be helpful to review professional opinions and analyst recommendations. Here’s why:

#Subheadings:

The Benefits of Investing in Nike

There are several benefits to investing in Nike. Here are three key advantages:

Investing in Nike vs. Competitor Stocks

Comparing Nike with its competitors can provide valuable insights into its investment potential. Here’s a quick comparison:

Financial Performance: Nike vs. Adidas

When it comes to financial performance, Nike and Adidas are two major players in the athletic apparel industry. Here’s a comparison of their key financial metrics:

Sustainability Practices: Nike vs. Under Armour

Considering sustainability practices is an important factor for socially conscious investors. Let’s compare Nike and Under Armour in terms of their commitment to sustainability:

#H2 – Additional headings after the main topic:

Nike’s Continued Innovation and Product Expansion

One of the key factors that make Nike a good company to invest in is its commitment to innovation and product expansion. Here’s why:

The Global Market Opportunity for Nike

The global market presents a significant opportunity for Nike’s growth. Let’s explore the potential:

Investing in Nike for the Long-Term

When considering Nike as an investment, it’s important to take a long-term perspective. Here’s why:

Summary

So, is Nike a good company to invest in? Overall, it seems like a solid choice for investors. Nike is a global leader in athletic footwear and apparel, with a strong brand and a track record of success. They have a large customer base and a strong presence in both the physical retail and online markets. Additionally, Nike has a history of innovation, constantly developing new products to stay ahead of the competition. While there may be some risks, such as changes in consumer preferences or economic downturns, Nike’s strong brand and market position make it an attractive option for investors.

In conclusion, Nike is a reputable company in the sports industry, offering products with a strong demand. Although there are potential risks, such as changes in the market or consumer preferences, Nike’s history of success and strategic initiatives make it an appealing investment opportunity. For anyone considering investing in Nike, it is essential to conduct thorough research and consider one’s individual financial goals and risk tolerance.

Recent Posts

Puma sneakers have different sizing depending on the specific style and model. It's recommended to check the product description or reviews for each sneaker to determine if they run small or large....

How To Lace Puma Shoes? If you're a fan of Puma shoes and want to learn how to lace them, you've come to the right place! Lacing your Puma shoes properly not only adds a stylish touch but also...