Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Michael Weinstein is a seasoned writer and a dedicated expert in work safety, footwear, and popular shoe brands. With years of research and expertise, he's...Read more

Is Adidas Publicly Traded? If you’re curious about whether you can invest in Adidas, you’ve come to the right place! Let’s dive into the world of stocks and find out if you can become a part-owner of this popular athletic brand.

But before we jump in, let me explain what being publicly traded means. When a company is publicly traded, it means that its ownership shares are available for anyone to buy and sell on a stock exchange, like a giant marketplace for stocks. So, can you find Adidas stock on one of these exchanges? Let’s find out!

Now, you might be wondering why this matters. Well, being publicly traded means that anyone, including you, can become a part-owner of the company. You can buy shares of the company’s stock and potentially benefit from its success. So, let’s uncover whether Adidas is publicly traded and if you can be a shareholder!

Is Adidas Publicly Traded?

Adidas is a globally recognized sportswear company known for its iconic three-stripes logo and quality athletic products. Many people wonder whether Adidas, as a company, is publicly traded. In this article, we will delve into the details of Adidas’ ownership structure and answer the question – is Adidas publicly traded?

The Ownership Structure of Adidas

Before we can address the question of whether Adidas is publicly traded, it is important to understand its ownership structure. Adidas AG, the parent company, is a publicly traded company listed on the Frankfurt Stock Exchange in Germany. The company’s shares are traded under the ticker symbol “ADS.” This means that individuals and institutional investors can buy and sell Adidas shares on the stock market.

Adidas AG operates as the holding company for the Adidas Group, which consists of several subsidiary brands, including Adidas, Reebok, and TaylorMade. While Adidas AG is listed on the stock exchange, the individual brands within the Adidas Group may not be publicly traded entities. Instead, they are divisions or subsidiaries of the publicly traded company, Adidas AG.

The Publicly Traded Nature of Adidas AG

As mentioned earlier, Adidas AG is a publicly traded company. This means that the company has gone through an initial public offering (IPO), making its shares available for purchase on the stock market. This decision allows Adidas AG to raise capital by selling shares to investors, which can then be used to fund operations, research and development, marketing, and various other activities.

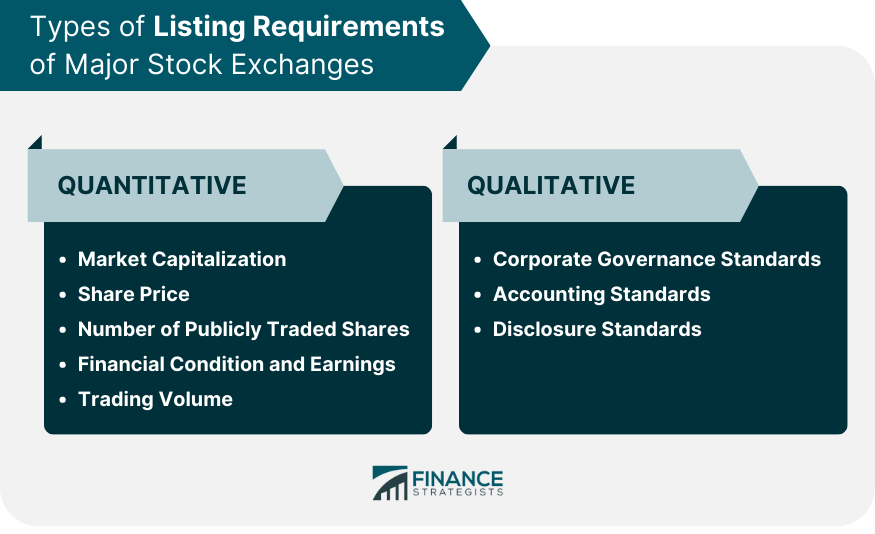

Being publicly traded also means that Adidas AG is subject to regulatory oversight and reporting requirements. The company is required to publish financial statements and report on its performance on a regular basis, providing transparency to shareholders and potential investors. This information enables investors to make informed decisions when trading Adidas shares.

Additionally, as a publicly traded company, Adidas AG is subject to the fluctuation of its stock price in response to market conditions, economic factors, and company-specific news. Investors can buy and sell Adidas shares on the stock exchange, potentially profiting from changes in share prices over time.

Is Reebok Publicly Traded?

One of the well-known subsidiary brands under the Adidas Group is Reebok. While Adidas AG, as the parent company, is publicly traded, Reebok is not. Reebok operates as a division or subsidiary of Adidas AG, benefiting from the resources and infrastructure of the parent company. However, its shares are not available for individual investors to trade on the stock market.

Reebok’s status as a non-publicly traded brand does not diminish its significance within the Adidas Group. Reebok continues to be a major player in the sportswear industry, offering a range of products and collaborating with athletes and celebrities to create innovative and stylish collections.

What Does Being Publicly Traded Mean for Investors?

For investors, the fact that Adidas AG is publicly traded means that they have the opportunity to own a stake in the company. By purchasing Adidas shares, investors can become partial owners and have the potential to benefit from the company’s success. If the company performs well, investors may see an increase in the value of their shares and receive dividends, which are a portion of the company’s profits distributed to shareholders.

However, investing in publicly traded companies also carries its risks. The value of the shares can fluctuate, and investors may experience losses if the stock price decreases. It is important for investors to conduct thorough research, analyze financial statements, and consider their risk tolerance before making investment decisions.

The Future of Adidas

As a publicly traded company, Adidas AG continues to evolve and innovate in the competitive sportswear market. The company is constantly striving to improve its products, expand its market reach, and adapt to changing consumer preferences. With a strong focus on sustainability and corporate social responsibility, Adidas aims to create a positive impact while delivering high-quality athletic gear.

In conclusion, Adidas AG is publicly traded, allowing investors to purchase and trade shares of the parent company. However, specific brands within the Adidas Group, such as Reebok, are not publicly traded and operate as subsidiaries under the Adidas AG umbrella. Investors interested in owning a piece of Adidas and participating in the company’s growth and success can do so by investing in Adidas AG shares. It is crucial for investors to carefully assess their investment goals and consult with a financial advisor before making any investment decisions.

Key Takeaways:

- Adidas is a publicly traded company.

- Being publicly traded means that Adidas is listed on a stock exchange and shares of the company can be bought and sold by investors.

- The ticker symbol for Adidas on the stock exchange is ADDYY.

- Investors can buy shares of Adidas to potentially profit from the company’s performance and growth.

- As a publicly traded company, Adidas is required to disclose financial information and meet regulatory requirements.

Frequently Asked Questions

Welcome to our frequently asked questions section on Adidas and their status as a publicly traded company. Here, we will address common questions related to Adidas’ ownership structure and stock availability.

1. How is Adidas structured as a company?

Adidas operates as a publicly traded corporation, which means it is owned by shareholders who hold the company’s stock. This ownership structure allows investors to buy and sell shares of Adidas on stock exchanges, such as the New York Stock Exchange (NYSE) or Frankfurt Stock Exchange.

Adidas has a board of directors that oversees the company’s operations and makes important decisions. The board is elected by the shareholders, who have voting rights in the company’s affairs.

2. What is the stock symbol for Adidas?

The stock symbol for Adidas is “ADS” on the Frankfurt Stock Exchange. This symbol represents the company’s shares that are traded on the exchange.

Investors and traders can use the stock symbol to identify and track the performance of Adidas’ stock in the financial markets.

3. Can I buy shares of Adidas as an individual investor?

Yes, individual investors can buy shares of Adidas if they have an account with a stockbroker or online trading platform that provides access to the stock market. By purchasing Adidas stock, individuals become partial owners of the company and have the opportunity to benefit from its financial performance.

However, it’s important to note that investing in stocks carries risks, including the potential loss of money. It’s advisable to do thorough research and consider your financial goals and risk tolerance before investing in any company’s stock, including Adidas.

4. Does Adidas pay dividends to its shareholders?

Yes, Adidas pays dividends to its shareholders. Dividends are a portion of the company’s profits that are distributed to shareholders as a reward for their investment. The amount of dividends paid by Adidas can vary from year to year, depending on the company’s performance and the decisions made by its board of directors.

It’s important to note that dividends are not guaranteed, and a company may choose to reinvest its profits back into the business instead. Dividend payments are typically made on a per-share basis, meaning the amount received by each shareholder depends on how many shares they own.

5. Can I trade Adidas stock internationally, even if I’m not in Germany?

Yes, you can trade Adidas stock internationally, even if you are not located in Germany. As a publicly traded company, Adidas’ stock can be bought and sold on various global stock exchanges, allowing investors from different countries to participate in the market.

International investors can access Adidas’ stock through their local stockbrokers or online trading platforms that offer international stock trading options. It’s important to consider any additional fees or regulations that may apply when trading stocks internationally.

6. Is Adidas listed in Nasdaq?

Adidas AG, the renowned sportswear company, is not listed in Nasdaq. Instead, it is traded under the ticker symbol ADDDF. While Nasdaq is a popular stock exchange, Adidas AG is listed on the Frankfurt Stock Exchange in Germany. As one of the world’s leading athletic brands, Adidas has a global presence and its shares can be easily accessed and traded through various international stock exchanges.

7. Who owns Adidas stock?

The ownership of Adidas stock is diversified, with a combination of institutional, retail, and individual investors. Institutional investors hold around 28.62% of the company’s stock, indicating the interest from large financial firms and organizations. Insiders, who are likely individuals closely associated with the company, own a minimal percentage of 0.09%. The majority, comprising 71.29%, is owned by public companies and individual investors, showcasing the appeal of Adidas stock to a wide range of investors. This diverse ownership structure reflects the popularity and widespread interest in Adidas as a valuable and attractive investment opportunity.

8. Is Adidas a trading company?

Adidas, originally known as a shoe company, has transformed into much more than just a footwear brand. It is traded in the Apparel & Textile Products Industry and falls under the Consumer Discretionary sector. Expanding its product range significantly, Adidas now offers a diverse array of apparel items, including T-shirts, pants, leggings, jackets, and hoodies. With its evolution from a shoe company to a multi-category brand, Adidas has become a leading player in the apparel market, catering to the fashion and style needs of individuals worldwide.

9. How many shares of Adidas stock are there?

Based on Adidas’s latest financial reports and stock price, the company currently has approximately 177,272,727 shares outstanding. As of the end of 2023, the number of shares outstanding remained the same, indicating stability in the company’s ownership structure. This figure is significant as it represents the portion of the company’s ownership that is publicly traded and available for investors to buy or sell on the stock market. With a substantial number of shares outstanding, Adidas demonstrates its size and popularity among investors, reflecting confidence in its performance and potential for future growth.

Summary

So, in a nutshell, Adidas is a company that is publicly traded. This means that anyone can buy and sell shares of its stock on the stock market. Being publicly traded allows Adidas to raise capital for growth and expansion. It also means that the company is accountable to its shareholders and must make financial information public. So, if you’re interested in investing in Adidas, you can check out the stock market and see if it’s a good fit for you!

To sum it up, Adidas is out there in the market, letting people buy and sell its stock. This helps the company grow and makes information about its finances available to the public. So, if you’re curious about investing in Adidas, you can find more information in the stock market.

Recent Posts

Puma sneakers have different sizing depending on the specific style and model. It's recommended to check the product description or reviews for each sneaker to determine if they run small or large....

How To Lace Puma Shoes? If you're a fan of Puma shoes and want to learn how to lace them, you've come to the right place! Lacing your Puma shoes properly not only adds a stylish touch but also...